Before we explain motor insurance, let’s start with understanding Insurance in one simple line.

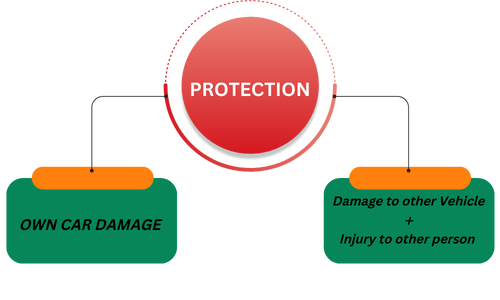

Insurance, in layperson’s terms, is basically a protection. So, in the case of motor insurance, protection against whom or what?

Motor insurance includes two protections.

Let us understand the above image from an example; suppose I am driving my car and I meet with an accident with another vehicle, then the Motor Insurance will provide protection against any damages that happen to My car as well as against any injuries that happen to the person driving the other vehicle and any damages that occur to his/her car.

The basic difference between “Own damage insurance cover” and “Third-party damage insurance cover” is that Third-party insurance cover is a statutory requirement in India, meaning your motor insurance has to include the second protection (Third Party Insurance) as per the law; having “own damage insurance cover” is optional and depends on you as it is not a mandatory insurance cover as per the Indian law.

Driving a motor vehicle without valid motor insurance in a public place is a punishable offense as per Motor Vehicle Act 1988.

Now that we have discussed the type of protection in motor insurance, let’s look at the type of policies available in the Indian market.

- Liability Only Policy (Only Third Party Insurance)

- Package Policy (Third Party +Damage to owner’s vehicle usually called Own Damage Cover)

Checklist before selecting a Motor Insurance

- Know your Insured’s Declared Value( IDV)

You must have noticed a term often used in Package policy is “IDV.”

IDV is your car’s current value, which is determined based on the Year of manufacture and the depreciation (wear and tear). IDV keeps on reducing as the age of the vehicle increases. So, always confirm the IDV of the car when you get the insurance proposal.

- Premium

It is the amount that you will pay for the insurance. It comprises two elements: own damage premium and third-party damage premium.

For own damage, different insurance companies (insurers) will charge a different premium for the same insurance cover. It is determined based on many factors such as IDV, deductibles, seating capacity, tax paid, driver details, etc.

Always remember to compare the deductibles. A deductible is an amount that you have to pay per claim before the insurer pays for the rest.

One important thing to know here is that the IRDAI (Insurance Regulatory and Development Authority of India) lays down third-party insurance liability premiums, which means that if you opt for a third-party insurance policy, all the insurance companies will give the insurance cover at the same price as it is regulated and capped by the IRDAI, whereas for the Own damage cover, no such capping or regulation is in place; hence different companies charge different premiums.

- No Claim Bonus

It is the benefit/discount you (The insured) get if you have not made any claim in the previous policy period. It ranges from 20% to 50%, but one important point that Customers often need to pay attention to is that the NO-CLAIM bonus discount is only available on the Own damage cover and not on the Third Party liability cover.

So, these are some important points you should always keep in mind before selecting motor insurance for your vehicle. Also, it is a good practice to check different websites like Policy bazaar, Acko, etc., to compare the premiums, benefits, no-claim bonus, IDV, and deductibles.

If you found the article useful, please provide your valuable feedback in the comments section, and if you have any other queries feel free to ask, we will be more than happy to answer!

2 thoughts on “Motor Insurance: Important Things You Should Know”